Solutions

The fastest and most secured renting solutions

Tenants

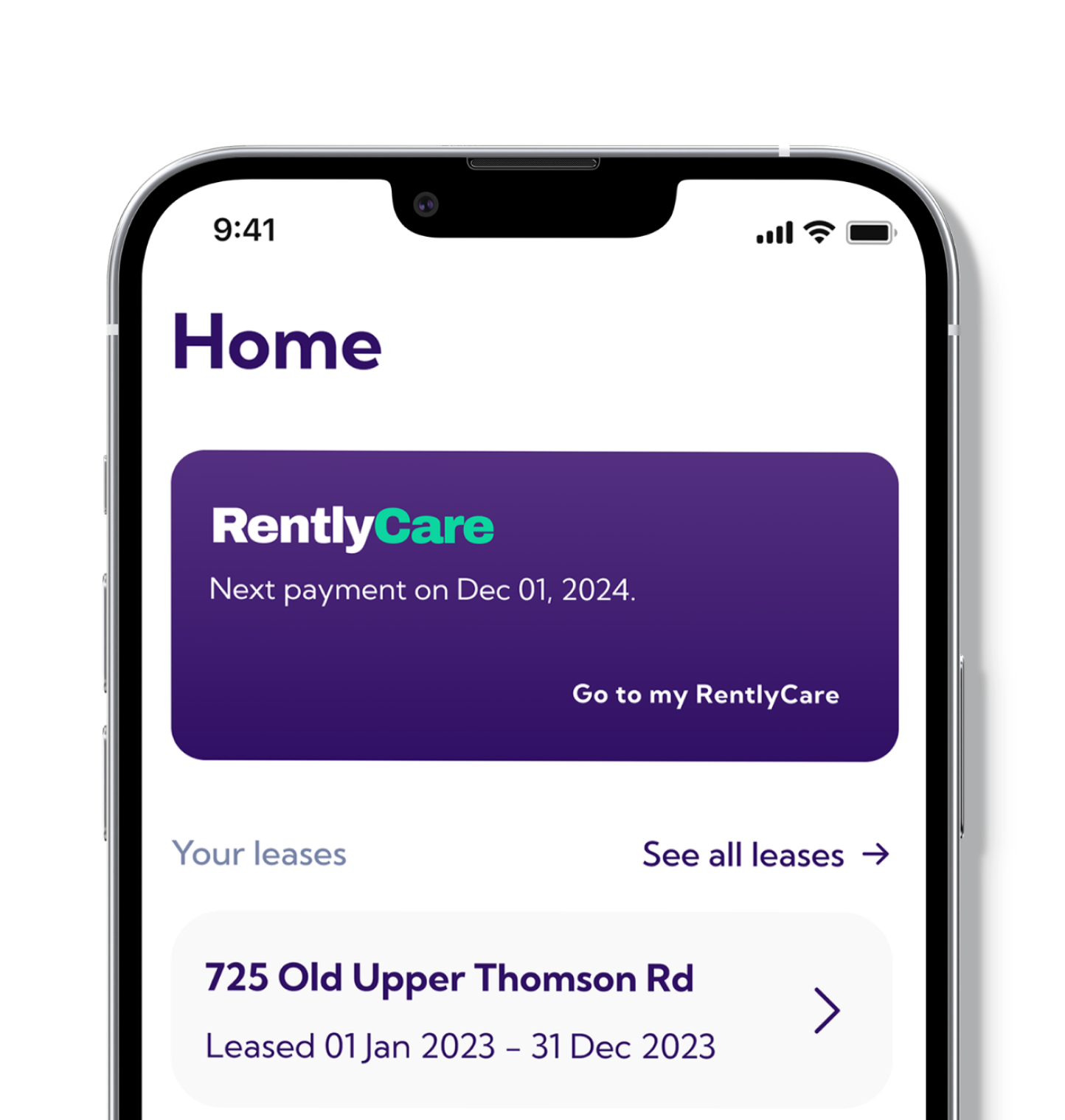

- Deposit-free rental

- Inventory management

- Digital signing

- Complimentary Insurance

- Fairness check on your tenancy agreement

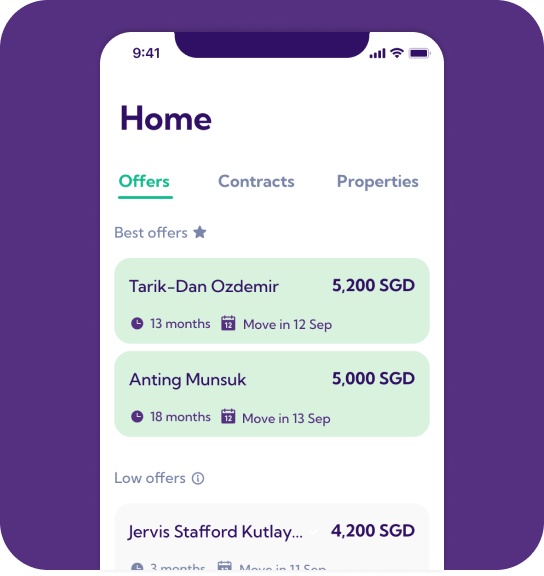

Landlords

- Tenant vetting

- Automated contracts

- Property listing

- Rent collection

- Complimentary Insurance

Agents

- Earn extra commission

- Zero listing fee

- Verified tenants

- Contract generation & digital signing

Enterprises

- Deposit financing

- Business loans

- Partnerships and integrations

Articles

Dive into the latest perspectives and updates on Rently and the wider PropTech industry.

Rently Stories

Hear all the stories that residents have to say about renting in Singapore.

Newsroom

See the latest media and press coverage to stay informed on the evolving landscape of real estate technology.

Blog

Explore topics that empower agents, tenants and landlords to create a safe and secure real estate environment.

Unlock your money, rent deposit-free.

You are eligible for our deposit-free service with properties from any landlord, agent, or rental platform.Get a quote

Renting made

easy

easy

Why tenants like renting with Rently

No security deposit

We cover it for you — you just pay your rent and a service fee.

Landlord screening

We make sure landlords and agents are legit, so you can rent with confidence.

A/C servicing

Handled by Rently's exclusive contractor, at no additional cost for tenants.

Insured by AIG

Home contents coverage included for eligible tenancies.

Landlords can list for

free

free

Discover the flexibility of listing any property type, on any rental range with Rently. Whether you have a cozy studio, family home, or even just a room, Rently makes it easy to connect with potential tenants!

Sign up now!Discover our featured properties

Our trusted partners in real estate

Adapted to your situation

Regardless of the context, our team adapts and finds a way to unlock your deposit money. We have dealt with a broad variety of cases and have helped finance $2 million worth of deposits.

Carlos Hernández“I want to get my deposit back from my landlord”

Carlos Hernández“I want to get my deposit back from my landlord”See how we handle it

Tan Mei Ling“I found a property and want to rent deposit-free”

Tan Mei Ling“I found a property and want to rent deposit-free”See how we handle it

Lim Sheng“I want to rent deposit-free and I have not found a property”

Lim Sheng“I want to rent deposit-free and I have not found a property”See how we handle it