Your finger on the pulse — that’s the number one rule. Ear on the ground. Up-to-date. In the know. Or, if you want to get fancy, au courant and its twin, au fait. In any investment you have to tattoo one of those sayings onto your forehead. Why? Because the future is both an opportunity as well as a challenge. Those that see it coming, that predict its outcome, are those that come out on top. The last thing you want is to be caught in a torrential downpour, looking about and wondering why everyone brought an umbrella — unaware that today’s forecast was expecting it. Let’s look at the future, or more to the point, the future of Singapore's property market and how you can get in on the action. How you can follow trends and make predictors based on them. As an investor, tenant, or industry professional, it's essential to stay on top of the latest insights and expert predictions. In the article, we'll give you clarity on where the market is headed, from rental sector dynamics to overall property trends. Critical tips that will give you the inside scoop and allow you to make informed decisions and seize upcoming opportunities within Singapore's ever evolving property landscape.

Property market trends — key insights investors, tenants, and homeowners

The real estate market can sometimes feel obtuse, like a labyrinth with no exit in sight – a complex network of factors influencing prices, locations, and overall buying or renting decisions that only cloud your decisions. Yet, within this intricate system, lies a hidden language: the language of property market trends. Understanding this language and its translation is critical, not just for investors but also tenants and homeowners – it helps them to navigate the ever shifting landscape of a region's price and opportunities with ease and confidence.

For investors — deciphering market trends properly is akin to possessing a treasure map. By analysing historical data and current movements, individuals can identify lucrative opportunities. Whether it is anticipating rising demand in specific areas or pinpointing undervalued properties, knowledge of trends equips them to make strategic acquisitions and maximise returns.

For tenants — navigating rental markets can be a painful and sometimes soul-sucking task. But understanding trends allows them to become savvy renters. They can anticipate potential rent fluctuations, negotiate better lease terms, and identify neighbourhoods experiencing a surge in rental options, potentially leading to more competitive pricing and higher quality accommodations.

Homeowners, too, benefit from a grasp of market trends. They can make informed decisions about renovations that align with current buyer preferences or strategically time the sale of their property to capitalise on periods of peak demand. Additionally, understanding market trends can help homeowners prepare for potential dips in property value, allowing them to make informed financial decisions for the future.

Current Singapore's property market — state and conditions

Singapore's property market finds itself in a state of balanced growth: while initial surges have subsided, both HDB and private property prices have stabilised. The consistent rollout of BTO projects has diverted some demand, though million-dollar HDB flats remain coveted. The rental market is also experiencing adjustments with new housing completions potentially leading to moderating rental prices. Experts predict this balanced trend to continue, but staying informed about future influences and supply demand shifts is crucial for navigating the market effectively.

In the following paragraphs, we'll delve into the latest rental trends shaping the sector, explore expert predictions for the future, and uncover potential opportunities you won't want to miss.

Factors driving the property market

Here's a look at some of the key drivers that are right now moving the market in the region, as of 2024, and which folks have to keep an eye on:

Economic Factors

- Interest Rates: Lower interest rates make mortgages more affordable, fuelling demand and potentially pushing prices up. Conversely, higher rates can dampen buying power and cool the market.

- Economic Growth: A strong economy translates to higher wages and increased consumer confidence, leading to a rise in property demand. On the contrary, economic downturns can cause a decrease in demand and potentially lower prices.

- Job Market: Ample job opportunities can attract new residents, boosting demand for housing. On the other hand, high unemployment can lead to a decrease in demand.

Social Factors

- Demographics: Population growth, particularly in specific age groups, can significantly impact demand for different types of properties.

- Lifestyle Preferences: Changing societal priorities, such as a desire for urban living or proximity to green spaces, can influence demand in specific locations.

- Government Policies: Government regulations, tax breaks, and housing initiatives can all significantly impact the property market by influencing affordability and accessibility.

Technological Factors

- Online Platforms: Online listing platforms increase transparency, potentially driving competition among sellers.

- PropTech Innovations: Virtual tours and big data analytics are changing the way properties are marketed and valued, potentially influencing market dynamics.

- Smart Homes: The growing popularity of intelligent home features can increase the appeal of certain properties, potentially influencing their value.

Key property market trends shaping the future of renting in Singapore

Property market trends in Singapore are rapidly transforming the landscape of renting. Understanding these key trends is essential for industry stakeholders to navigate the evolving property market successfully:

Technology Integration in Property Management and Rentals

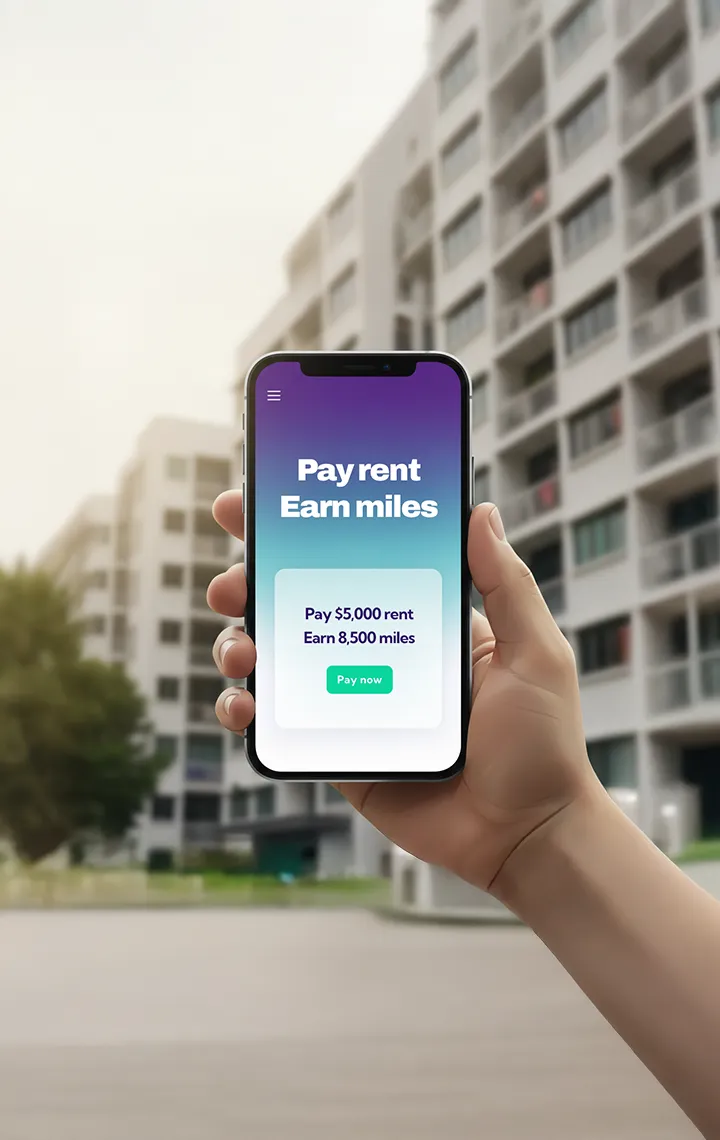

The integration of technology, such as intelligent home features, digital platforms for property listings and virtual property viewings, online rent payment systems, and data analytics tools, are enhancing efficiency, convenience, and transparency in the rental process.

Shifts in Tenant Demands and Expectations

Tenants are increasingly seeking properties with flexible lease terms, high-quality amenities, sustainable features, and proximity to transportation hubs and amenities. There is also a growing demand for co-living spaces, pet-friendly accommodations, and properties designed for remote work setups, reflecting changing lifestyle preferences among renters.

Regulatory Changes and Their Impacts

Amendments to the Residential Tenancies Act and the implementation of additional stamp duties for foreign buyers and investors, are influencing the rental market in Singapore. Landlords and tenants need to stay informed about these regulations to ensure compliance and understand their implications on tenancy agreements and rental pricing.

The Rise of Co-Living Spaces

This trend is reshaping the rental market by offering shared living arrangements that cater to young professionals, expatriates, and digital nomads. These spaces provide a sense of community, flexibility in lease terms, and access to amenities and services.

New Investment Opportunities and Challenges

The evolving rental market presents new investment opportunities for property developers, institutional investors, and landlords looking to capitalise on the growing demand for rental properties. However, challenges such as rising competition, fluctuating rental yields, and regulatory uncertainties require careful consideration and strategic planning when entering the rental market.

The Influence of Global Economic and Socio-Political Factors

Geopolitical tensions, economic downturns, and public health crises have a significant impact on the rental market. In this world you only have to switch on Jurassic Park, and take a cue from Malcolm, to get an idea of how most ecosystems work — entropy, chaos, disorder. The more complex, the more likely it is to stray off course. The slightest deviation - the proverbial wings of a butterfly half a world away - can create a storm of epic proportions in your system. Fluctuations in foreign investments, changes in immigration policies, a cybercriminal breach at an institution, a political scandal, shifts in consumer confidence influence market dynamics, dogs and cats getting along together, and anything in between can create chaos — this highlights the interconnected nature of the global real estate market.

Predictions for the Singapore property rental market

Expert Opinions on Future Property Market Trends

- Industry experts anticipate continued growth in demand for rental properties, driven by factors such as urbanisation, population growth, and lifestyle preferences favouring renting over homeownership.

- The integration of technology in property management and rentals is expected to become more prevalent.

- Co-living spaces are projected to gain further traction, catering to the evolving needs of renters seeking communal living arrangements, flexible lease terms, and shared amenities.

- Regulatory changes may impact rental market dynamics and shape landlord tenant relationships.

- Global economic and socio-political factors could influence foreign investment flows, expatriate mobility, and overall market sentiment in the rental sector.

Data Driven Forecasts for Rental Prices, Demand, and Supply

- Data analytics and market research suggest that rental prices in prime residential areas are likely to stabilise or experience modest growth in the near future, supported by sustained demand for quality rental accommodations.

- Demand for rental properties in suburban and fringe areas may increase as tenants prioritise affordability and accessibility, outside the central business district.

- Factors such as changing demographic trends, government infrastructure projects, and macroeconomic conditions will influence rental demand and supply patterns, shaping rental market performance in specific locations and property types.

Singapore property market — getting in on the action

The Singapore property market, with its rental sector at the front, is undergoing a period of exciting transformation. And wherever there is a metamorphosis, of any type, there is an opportunity — a change occurrence for a savvy investor to hook their lines and ride the proverbial coattails of that energy flux. Understanding current property market trends, from tech integration to tenant preference shifts, is crucial for anyone wanting to invest part of their likelihood in real estate. By staying informed - with your ear pressed tight against the cold iron of the railroad track - on expert predictions, data driven forecasts, and external influences, stakeholders can make strategic decisions and capitalise on upcoming opportunities. As the rental market embraces technology, catering to changing tenant demands, and adapting to regulatory shifts, will be essential for their success in Singapore's dynamic property market.